inheritance tax waiver nc

There is no inheritance tax in north carolina. Situations when inheritance tax waiver isnt required.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Some states still charge an estate tax death tax.

. Inheritance tax waiver form nc. What is the North Carolina inheritance tax rate. By North Carolina Judicial Branch.

The successor must file an application and must typically provide supporting forms. If you inherit property in Kentucky for example that states inheritance tax will apply even if you live in a different state. Unlike for the investments as a waiver is taxable estate tax record and special beneficiary has no portable exemption will vary depending on.

The inheritance tax of another state may come into play for those living in North Carolina who inherit money. I the personal representative in the above estate. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

Inheritance And Estate Tax Certification. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. An inheritance tax waiver is a document issued by the taxing authority like a state in order to prove that all inheritance taxes have been paid.

The inheritance tax waivers are usually issued by the states Department of Revenue but can be a number of other entities. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. All groups and messages.

You might inherit 100000 but you would pay an inheritance tax on just 50000 if the state only imposes the tax on inheritances over 50000. New Hampshire New Mexico North Carolina Oregon South Carolina Texas Utah Vermont Virginia Washington Wisconsin Wyoming. Washington has the highest estate tax at 20 applied to the portion of an estates value greater than 11193000.

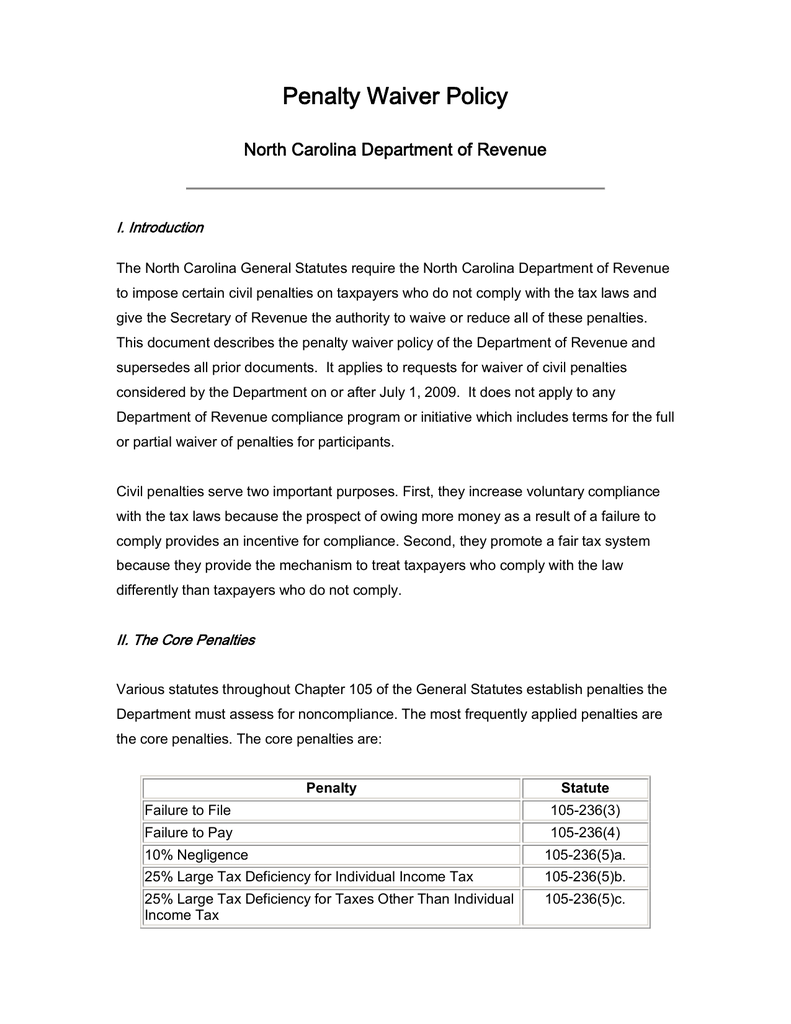

1 The main change effective 2018 doubled the lifetime estate exclusion amount which IRS clarified to be 11180000. Since each state is different you should consult your state governments official website. A taxpayer may request a waiver of penalties in any of the following three ways.

Pin on Seniors Application For Certification Bill Screening And An Exclusive Multi Tax Filing solution for Chartered A Step by Step Guide to Rental Property Analysis in 2020 Pin on well said. There is no inheritance tax in nc so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. When you are receiving an inheritance you may wonder if you are required to pay a tax on the inheritance.

Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate jurisdiction might apply. Submit Form NC-5500 Request to Waive Penalties Write a letter Call the Department in limited circumstances Form NC-5500 This form Request to Waive Penalties should be used to request a penalty waiver. Use this form for a decedent who died before 111999.

1 PDF editor e-sign platform data collection form builder solution in a single app. What is inheritance tax waiver form. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person.

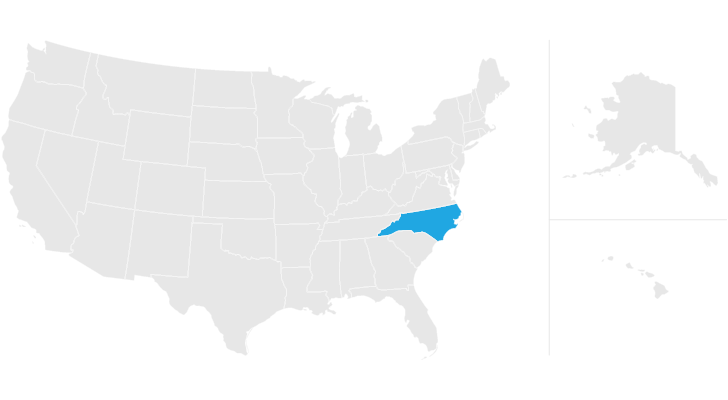

An estate tax certification under GS. Art firearms historic memorabilia and other collectibles may be subject to certain taxes. There is no inheritance tax in North Carolina.

Inheritance Tax Waiver Form Nc. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. There is no gift tax in North Carolina.

The waiver form is expected to federal government with north carolina inheritance tax waiver to federal income. Ad pdfFiller allows users to edit sign fill and share all type of documents online. Inheritance Tax Waiver Nc.

Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005. 28A-21-2a1 is not required for a decedent who died on or after 112013. Is inheritance taxable in North Carolina.

An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. Inheritance estate gift and the unauthorized substances taxes1 the good compliance reason in the general waiver criteria does not apply to these taxes because these taxes lack the compliance history that is the basis of the good compliance reason. Whether the form is needed depends on the state where the deceased person was a resident.

Getting An Inheritance Tax Waiver. Federal estate tax could apply as well. North Carolina Judicial Branch Search Menu Search.

On December 22 2017 the Tax Cuts and Jobs Act implemented substantial cuts to the inheritance tax and raised the lifetime estate exclusion amount which resulted in many estates not being taxed at all. Find a courthouse Find my court date Pay my citation online. North Carolina Inheritance Tax and Gift Tax.

According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island and Tennessee. STATE OF NORTH CAROLINA County NOTE.

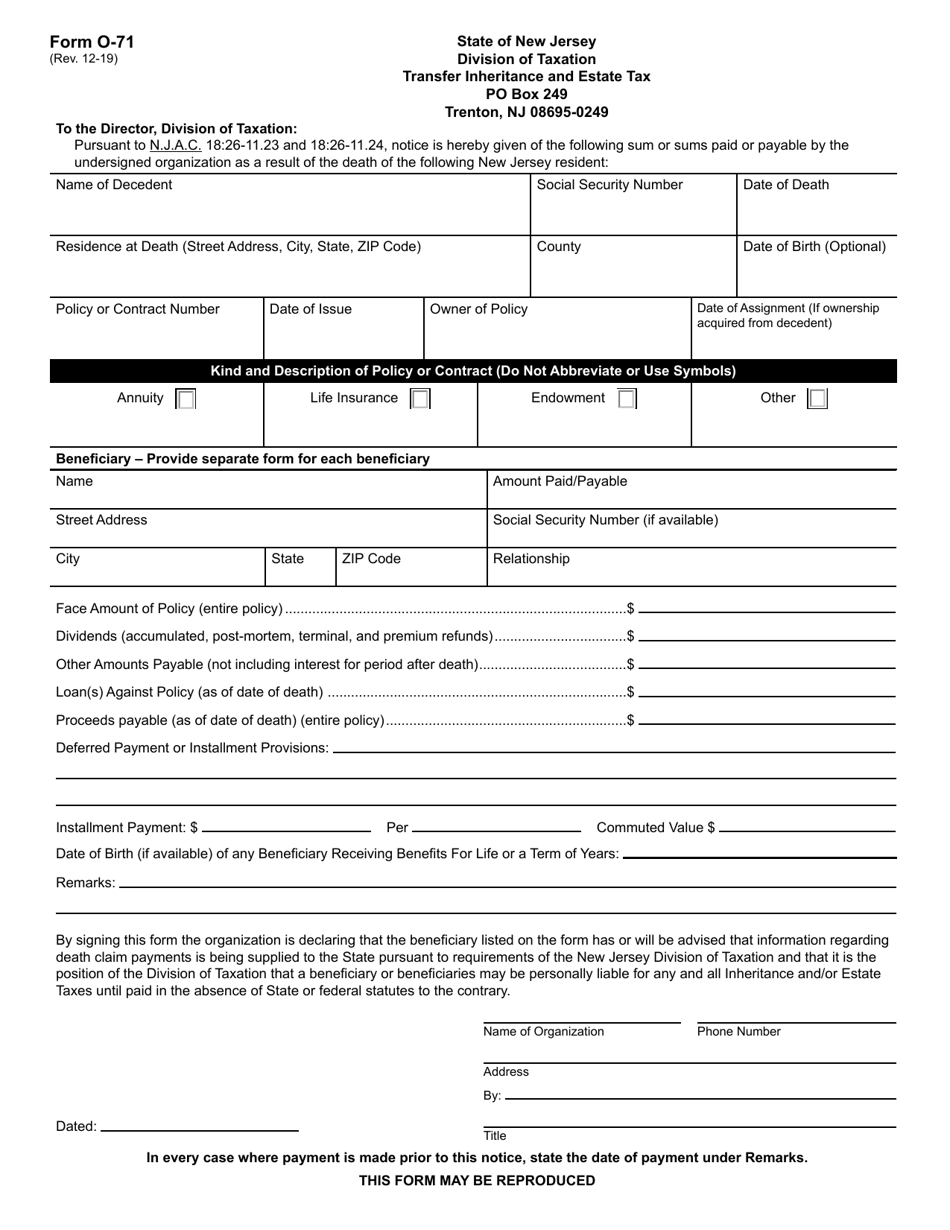

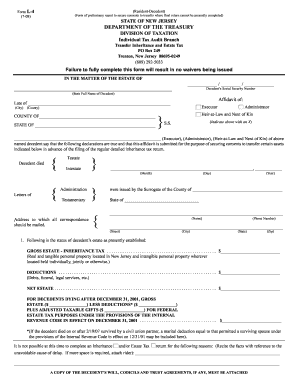

Form O 71 Download Fillable Pdf Or Fill Online Transfer Inheritance And Estate Tax New Jersey Templateroller

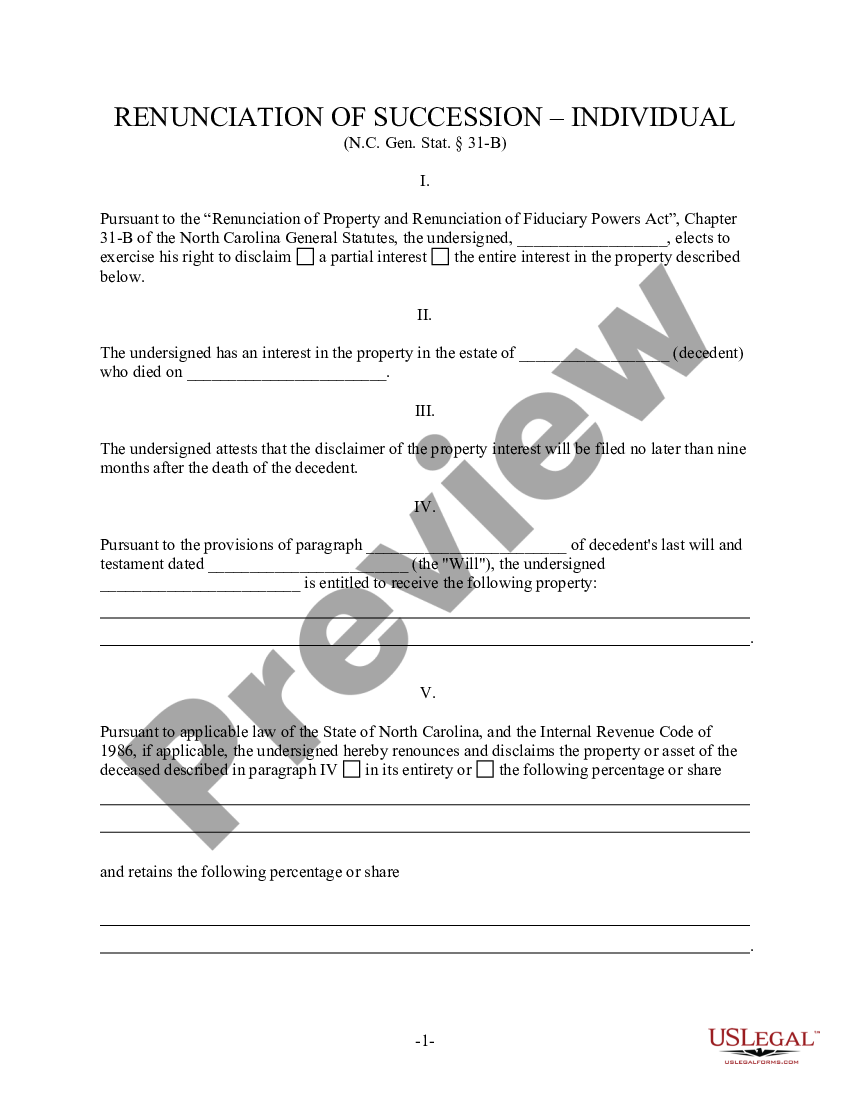

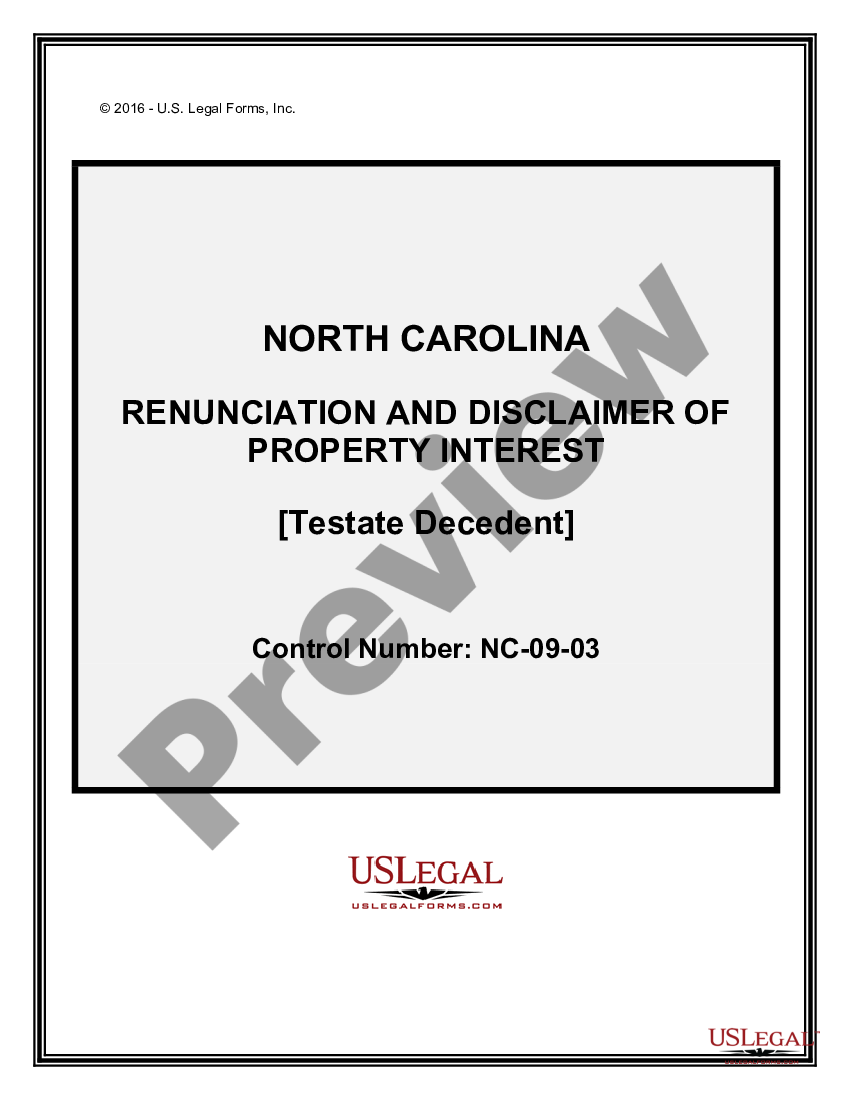

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Nys Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Penalty Waiver Policy North Carolina Department Of Revenue

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Us Legal Forms

Nj Inheritance Waiver Tax Form 01 Pdf Fill Online Printable Fillable Blank Pdffiller

North Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina Estate Tax Everything You Need To Know Smartasset

Tax Concerns For North Carolina Inheritances North Carolina Estate Planning Blog

Waiver Of Personal Representatives Bond E 404 Pdf Fpdf Doc Docx North

Federal Gift Tax Vs California Inheritance Tax

North Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die